Harnessing the power of AI & ML for Analytics in Banking and Financial Services

Harnessing the power of AI & ML for Analytics in Banking and Financial Services

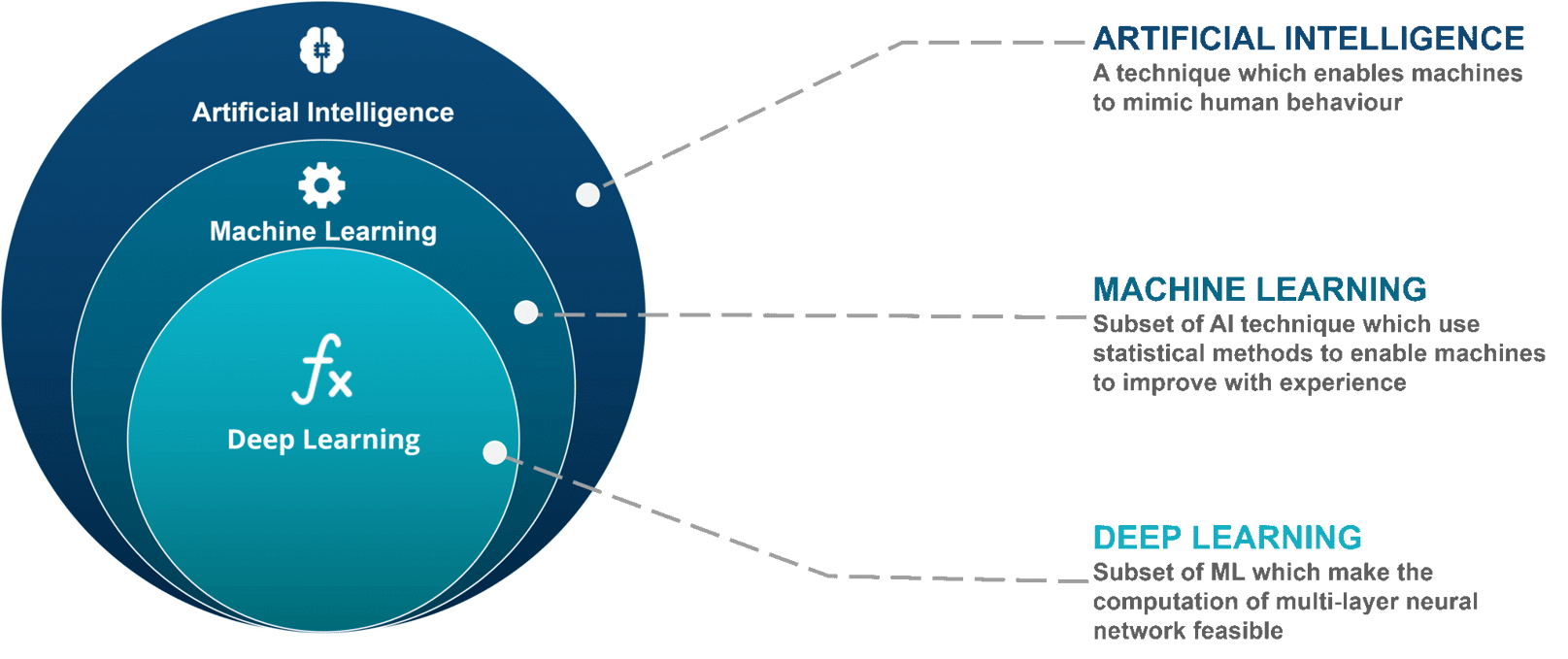

In this technological era, Artificial Intelligence (AI) is termed as one of the four-pillars in the ABCD of emerging technologies. The proliferation of technology in business has led to a tremendous shift in the way customers prefer to interact with the banks. In response, banks are investing heavily in adopting emerging technologies such as Blockchain, Artificial Intelligence (AI), and Robotic Process Automation (RPA) in several processes.

Machine learning algorithms and data science techniques can significantly improve a bank's analytics strategy. There are numerous implications that ML can bring to enrich the banking experience in areas such as Risk Management, Fraud Prevention, Credit Management, Personalized Banking, etc.

Data analytics has emerged as one of the most important agendas in today’s business world. Banks need to go beyond traditional analytics models and start leveraging Artificial Intelligence (AI) and Machine Learning (ML) to provide seamless experience that meets the customer expectations.

Data Advantage of Modern Era

The foundation of the opportunities in today’s digital presence is the availability of real-time and detailed data (large volume), aggregated with higher accuracy.

Deploying AI and ML solutions can help generate a range of benefits such as:

- Empowering business users to uncover more insights, quickly

- Revealing hidden patterns and performance drivers through predictive insights and automatic natural-language explanations powered by Machine Learning

- Enhancing revenue

- Reducing risk and improving compliance

- Improving and designing better operations

- Accelerating time to value, by providing intelligent automated operations and reducing overhead, thus lowering total cost of ownership

Advanced Analytics - Conceptual Architecture

OneGlobe leverages various tools and technologies from Oracle, AWS, Google Cloud Platform as well as opensource stacks that combine machine learning, adaptive intelligence, and service automation to create an analytics platform for its customers that breaks downbarriers between people, places, data, and systems.

Over the last few years, the BFSI Sector has been disrupted in many ways, thanks to machine learning, which has evolved beyond the realm of R&D. With the enormous amount of digital data in hand, and the advent of emerging technologies coupled with ease of accessibility and affordability, banking and financial organizations started to explore the possibilities of machine learning for putting the customer at the heart of the business to derive business value and customer satisfaction.

Our Next-Gen, technology-agnostic machine learning solutions power the business model to attain new heights by minimizing the change or risk associated with it. When it comes to developing machine learning from the scratch or implementing a small change to your existing systems, our experts anticipate the output of the technology choice, be it Python, R or any other technology, to offer the best possible solution with security at the heart. We have built machine learning capabilities directly on Oracle, AWS and GCP Cloud BI platforms, thereby making functionality like ML and predictive analytics available to regular business. We also build and provide a variety of machine learning algorithms covering both supervised learning (e.g. classification) and unsupervised learning (e.g. clustering).

For instance, we came up with a solution using python to address the major concern of a public sector bank, which is to see the holistic view of a customer. We built a similarity algorithm from the scratch to de-duplicate the entire database to uniquely identify the customer at multiple levels, which reduces a week of manual effort to a 10 minute job run.

In another case, a private sector bank was looking to improve customer service by monitoring the sentiment of the customers on social media. We leveraged Oracle’s Advanced Analytics Platform with out-of-the-box machine learning capabilities to turn the high volumes of data into actionable insights, to optimize the service portfolio of the bank and to improve the customer satisfaction.

Applications of AI and ML in Banking and Financial Services

1. ATM Location Intelligence & Transaction Analysis

India’s largest public sector bank has leveraged Oracle Analytics Cloud to effectively identify, visualize, and analyze data using AI and ML to decipher insights from ATM Analytics. After implementing our solution, the bank gained roughly 15% savings in interchange fees.

3. ATM Cash Reload

A large public sector bank has leveraged our ML algorithms for predicting cash refilling at ATMs. Using macro-economic factors such as rainy and non- rainy days, bank is now able to predict the cash load requirement at different ATMs located in the country.

2. Loan Default Prediction

A Private Non-Banking Financial Company used our ML algorithms to predict the loan defaulters and prevent credit risks in business. Now, the company’s default has reduced by 2%.

4. ATM Downtime prediction

A large private sector bank has used our machine learning algorithms for ATM downtime prediction. Now, the bank can predictdowntime in advance, take appropriate measures and handle SLAs effectively.

Possible Use Cases:

Following are the some of the potential business cases for machine learning, which our analytics team is currently working on.

- Sentiment Analysis

- Customer Acquisition

- Churn Prediction

- Leave Prediction

The Way Forward

By making it possible for banking and finance professionals to work better and smarter, AI powered systems will help them optimize their time, enabling them to use their human judgment to analyze a broader and deeper set of data and documents.

Leave your thought here

Your email address will not be published. Required fields are marked *